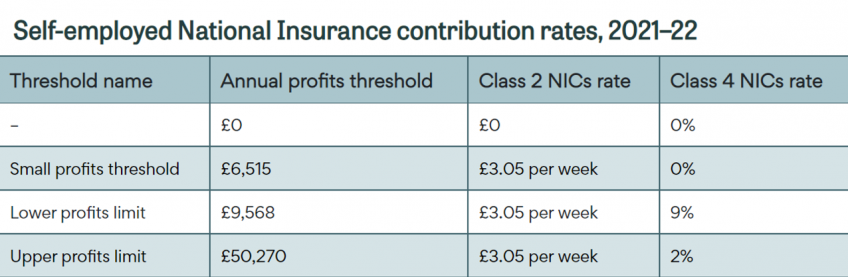

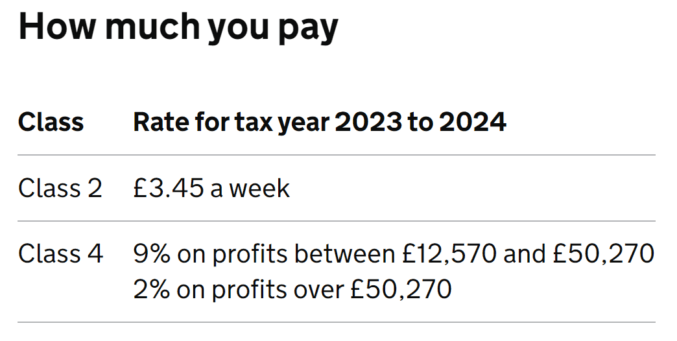

HMRC - Are you self-employed? Are you confused about NI rates and class 2 contributions? This helpful guide explains the different rates for the self-employed. https://www.gov.uk/self-employed-national-insurance-rates?utm_source=HMRCFacebook&utm_medium ...